Most of the open medical schemes in South Africa were quick to respond to the new challenges relating to the outbreak of the COVID-19 virus and its associated economic challenges due to the lockdown measures announced by Government.

Medical schemes are governed by laws and regulations, promulgated through a parliamentary process and overseen by the Council for Medical Schemes. While lockdown started towards the end of March, the first regulations linked to the declaration of a disaster and COVID-19 were already published by 15 March 2020. Through the Disaster Management Act Regulations, the Competition Act, the Medical Schemes Act Regulations and Council for Medical Schemes Circulars, the landscape for the healthcare industry and medical schemes specifically was changed to adapt to the new normal.

By 7 May 2020, both negative and positive tests for COVID-19 were regulated to be regarded as Prescribed Minimum Benefits (PMB), if certain requirements were met. Schemes are therefore obliged to fund the costs. A further list of COVID-19 treatment codes were published, allowing for the full spectrum of treatment, including hospitalisation, ventilator treatment and even oxygen level monitors, where medically required, to be funded by medical schemes.

At the same time, medical schemes began to allocate resources to telemedicine offerings against the background of the risks associated with contact consultations. Medical schemes also announced special support measures to members who had difficulty affording contributions. These included downgrades, using built-up savings to fund contributions and even temporary terminations, without underwriting being applied when members rejoin later. Similar relief measures were announced to companies experiencing cash flow strain, including premium deferral holidays for qualifying groups.

All medical schemes put out communications about the virus, how to access benefits and how it would be funded. Some offered additional “return-to-work” screening/testing/cleaning support, and new industries emerged where these services were offered to employers at a cost.

How Will Your Medical Scheme’s Reserve (and Future Increases) Be Impacted by COVID-19?

The big question which has emerged is how the new disease, the relief measures, the treatment and its related costs would impact on medical scheme reserves.

We know that medical schemes are required to have reserves equal to 3 months’ contributions. The rationale behind these substantial reserves is that schemes will be able to absorb the costs of an unexpected inflow of claims – exactly what we are now experiencing.

Where relief measures allow members to downgrade or defer contributions interest free, the impact is carried by the reserves of the scheme. Further impact on reserves include lower investment returns due to market volatility and the drop in interest rates, over and above the unbudgeted claims mentioned earlier.

Discovery has calculated three scenarios (low/medium/high) in terms of additional costs related to COVID-19 for the 32.45% of the industry membership for whom they provide administration (see graphs below). The cost estimates are broadly divided between testing and hospitalisation.

Discovery has calculated that a consultation and test will cost around R1 300. Given the percentage of membership under their administration who will be required to have testing done over the next 18 months, the three scenarios are expected to cost R2.4 billion, R3.6 billion and R10.2 billion respectively. This is for testing only.

Based upon their current statistics which reflect that 23% of positive cases will require hospitilisation, with an average cost of R84 700 per admission, you can add a further R4.9 billion, R11.5 billion and R21.6 billion respectively to each of the above scenario totals. This is in respect of the estimated cost of hospitalisation and ICU admission.

Effectively, this means that the test and hospitalisation costs together would require an additional R45 to R200 (with a median of R121 per beneficiary per month) to fund. This should be seen against the background of the total expenditure by medical schemes of R173.3 billion towards hospitalisation in 2018, which equates to just over R600 per beneficiary, per month.

Medical schemes projected to potentially incur additional claims of between R7.3 billion and R31.8 billion related to COVID-19 during the pandemic

Equivalent to an additional cost of between R816 and R3 561 per beneficiary for 2020 and the first half of 2021.

Yet, during lockdown and beyond, depending on resource availability, only critically necessary operations are being approved. Most planned operations have been postponed and this has saved medical schemes a huge amount. We also know that vehicle accidents and violent crimes have been substantially lower during lockdown, offering further cost relief.

In a 25 May 2020 statement sharing their results for the first 6 months ending 31 March 2020, Netcare reported a substantial drop in revenue for March 2020, due to COVID-19 preparation and the postponement of non-urgent medical and trauma cases. They also mentioned a decline of up to 60% in unnatural deaths in South Africa during the first months of lockdown. Netcare’s acute hospital days for April 2020 declined by 49.5% compared to April 2019.

Bearing in mind that, according to the CMS Report of 2018/19, hospitalisation makes up 37% of all medical scheme claims’ costs then a 50% reduction as reported by Netcare during the initial lockdown months will certainly result in substantial savings for medical schemes for the foreseeable future, until COVID-19 cases start pushing up hospital occupancy rates and the postponed elective procedures resume again.

We therefore do not expect overall contribution increases to be much higher than previous years, as the cost drivers and cost savers will hopefully cancel each other out. Even at Discovery’s highest scenario (R200 additional monthly cost to fund COVID-19), this only equates to an 11% premium increase. Given a conservatively estimated, non-urgent hospital occupancy drop of only 25%, one could assume that just about all of the above potential increases could be off-set by the simultaneous savings; bearing in mind, the R200 represents the worst case scenario.

It would be interesting to see whether the CMS will be more willing to formally push for a change from the regulated 25% reserve requirement, to a risk-based reserve requirement, as has been officially contemplated and investigated for a number of years. This will mean that a number of the larger schemes would be required to have substantially lower reserves. Such lower reserves would support the broader strategy of providing relief to consumers, as the potential savings could be passed on to them in the form of lower/no contribution increases for a year or two.

Source:

Council for Medical Schemes Report, 2018/2019;

Discovery White Paper: Counting the cost of COVID-19, 1 June 2020

Netcare Statement, 25 May 2020

A Virus Changes Our Lives Forever

Working from home, and adhering to the social distancing measures, has changed our lives forever. Our social interaction will never be the same again. Initially regulated, gatherings will later become voluntarily smaller and less intimate, as the risk of spreading the virus becomes part of our psyche. We will never again have the disregard for personal hygiene and low-level awareness of physical contact as before COVID-19. We have changed our social interaction habits to align with what we are bombarded with every day through mass indoctrinate style communication – even on the highway electronic signs. The sharing of a glass, or taking sips from the same bottle, is something of the past. Regular washing of hands will become a habit which, if not done, will be frowned upon. In sport, the habits of using saliva to shine a cricket ball and/or licking your fingers to create better grip of the ball or your equipment, and getting rid of excess saliva by spitting it out onto the field or track surface, will forever in future be taboo.

For a long time into the future, the wearing of masks will be the norm and could become a fashion item. Older people have been forced to up their skills on computers and other devices, as we have fast forwarded the expected changes in the use of technology predicted for the next five to ten years, into two months in the first half of 2020. Many people are, for the first time ever, having virtual meetings or gatherings, for work and socially. Many families are venturing into paid home entertainment and others have had food, groceries or clothing delivered – also for the first time. This will become the new norm.

Large offices with employees stacked in side by side are a thing of the past. If your company has considered agile seating and flexi-time, they will probably make that the official policy in the near future.

In an article on the internet titled “How people and companies feel about working remotely” by Nick Routly, published on 1 June 2020, he discusses the pros and cons of working from home. His research indicates that 98% of people would like the option to work remotely for the rest of their careers. He lists a flexible schedule (32%), ability to work from any location (26%), and no more commuting (21%) as the biggest reported benefits. On the other hand, the inability to “unplug” from work and loneliness are the factors which weigh in against working from home. According to Routly, barriers to implementing a remote work policy include the required culture change, privacy and data security issues, technology requirements and the lack of understanding the benefits of flexible working.

Broad-scaled working from home will probably provide much-needed relief on our traffic peaks and create an all-day travel spread, but on a less condensed scale with resultant savings in office costs and travel costs for businesses. Why would you fly across the country to attend a meeting, given our current efficiency with Teams or Zoom or Skype? Even group WhatsApp video calls are being widely used.

Source:

www.visualcapitalist.com: How people and companies feel about working remotely (Nick Routly, 1 June 2020)

There will be industries which will gain and others which will shrink due to the new world, post COVID-19

According to an internet article written by Professor Michael Wade, titled “Coronavirus: your guide to winners and losers in the business world” which appeared on 20 March 2020 in “The Conversation”, he indicated that due to the virus, there could be winners, losers and in-betweeners. The last-mentioned category of businesses could end up among the first two, depending on their response to the challenges.

Industries which could win include e-commerce market places, like Amazon, who at the time of writing that article had already employed 100 000 additional staff to deal with the increased demand. Other winners include pharmaceuticals (providing materials and products linked to the pandemic), logistics/delivery, which has become a necessity given our new buying methods and videoconferencing (Zoom, Sisco Webex, Microsoft Skype and Teams being specifically mentioned). The last winner according to Wade, is entertainment streaming and gaming, where giants such as Netflix, Amazon and Disney are experiencing a high increase in volumes.

The losing industries include airlines, trains and cruise ships where activity has dropped by over 80% and will remain substantially lower for some time. Tourism as a sector will be severely impacted and lead to many job losses. Oil and gas demand is also expected to remain low for the foreseeable future, driving the price of these commodities down.

Investment banking is another sector where the slump in deals will cause a drop in income and job losses. With people more confined to their homes, traditional retail will also be negatively impacted. The property companies will also suffer under lower turnovers in malls and it might take some time for traditional shopping patterns to return.

Professional sport is another loser, as most activities are cancelled or postponed and we could expect the restriction on spectators to remain for the foreseeable future. Screening rights and advertisements linked to live sport events are expected to drop substantially.

Cinemas, the traditional way we enjoyed watching movies, will take a beating in terms of box office revenues, given the surge in home entertainment.

The in-betweeners are the industries which would have to move swiftly and be innovative to take advantage of new and emerging opportunities to survive.

Banking will suffer as individuals and businesses struggle to pay back loans. As we slip into a global recession, the market for financial products will fall. Yet, according to Wade, the banks can build lasting relationships with clients by offering needed assistance during these times. Many consumers might require temporary solutions which could bolster demand for small- and medium-sized loans.

In healthcare, the innovative players will gain, while others might be pushed past breaking point. The same applies to manufacturers, where more agile operators will shift to making new products in high demand – motor manufacturers producing ventilators, being the typical example.

With most schools and universities being closed, the institutions that have expanded the scale and scope of their operations online will gain into the future.

Source:

www.theconversation.com Coronavirus: your guide to winners and losers in the business world. Prof Michael Wade International Institute for Management Development 20 March 2020

Strategic focus for companies to survive

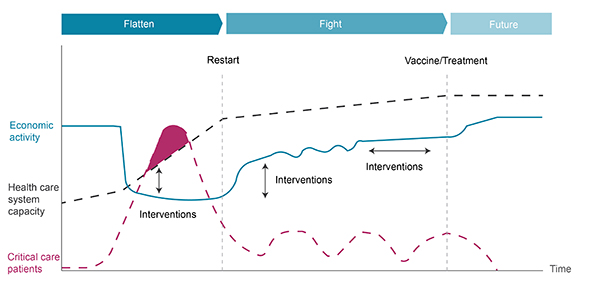

In an internet article, published on 16 April 2020, titled “COVID-19: Win the fight, win the future”, the authors Marin Gjaja, Lars Faeste, Gerry Hansell and Doug Hohner suggest that for companies to survive post COVID-19 they would need to have robust plans of action. They identify three distinct phases, namely: Flatten, Fight (restarting the economy and lasting 12 to 36 months) and Future, which will start only after a vaccine or effective treatment has been developed and deployed. Companies should use scenario planning to overcome the uncertainty and help them to understand the underlying drivers of outcomes, given the different trajectories of the virus outbreak around the world.

The interesting graph below illustrates the three key input differentiators and shows how these typically would interact during each of the three phases.

The journey depends on a range of factors, but the basic shape is the same.

Source:

www.bcg.com Win the fight, win the future Marin Gjaja, Lars Faeste, Gerry Hansel, Doug Hohan 16 April 2020

COVID-19: a defining moment in history?

If one were to survey the important moments/events over the centuries of civilisation to determine which had the biggest impact on the world, the results can vary significantly, depending on the perspective of the person(s) compiling it. Based on nationality, religion, political views, culture and interests, each list would highlight different aspects.

In an article written by accountant and world traveller, Rebecca Graf for Owlcation (https://owlcation.com) on 24 January 2018, she listed the major events which shaped the world and touched every culture. Her unbiased list contains the two World Wars, the Rennaisance, the fall of the Berlin Wall, the Reformation, the American Revolution, Gutenberg’s printing press and the lives of Jesus of Nazareth and Mohammed.

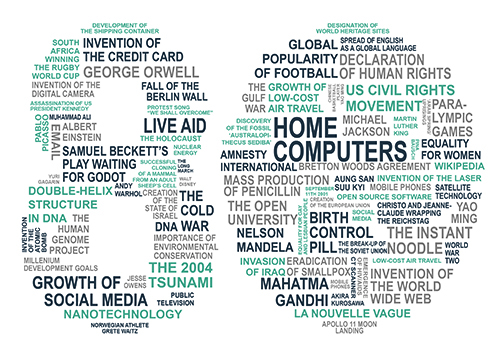

One would imagine that technological breakthroughs like the internet might also qualify for inclusion on most people’s lists, given its impact and the advances that have resulted from it over the last 30 years. In the British Council publication (www.britishcouncil.org), marking their 80th anniversary, they reflect that it took radio broadcast 38 years to reach the first 50 million users and television took 13 years. The web however, reached this milestone in 4 years, making it the fastest growing communication medium of all time. Their top 10 out of 80 moments that shaped the world over the preceding 80 years, includes interesting entries such as home computers, mass production of penicillin, the declaration of human rights, the terrorist attacks of 11 September and the emergence of international terrorism, the rise in global awareness of environmental protection and conservation, the influence of Nelson Mandela, the breakup of the Soviet Union, the invention of the atomic bomb and the attacks on Hiroshima and Nagasaki, as well as the move towards greater equality for women in many parts of the world.

While each of the aforementioned moments had a profound impact on many lives, if one considers COVID-19’s massive impact on the economy and the way society operates, and the effort and resources being mobilised to combat its spread, then strong arguments could be made for the current pandemic to be added to such lists compiled in future.

Source:

www.owlcation.com/humanities/The 10 most important moments in history – an illustrated guide Rebecca Graf 24 January 2018

https://www.britishcouncil.org/sites/default/files/80-moments-report.pdf

DISCLAIMER

This communication provides information and opinions of a general nature. Simeka Health accepts no liability or responsibility if any information is incorrect or any loss or damage that may arise from reliance of information contained herein. It does not constitute advice and no part thereof should be relied upon without seeking appropriate professional advice. Simeka Health (Pty) Ltd is an authorised Financial Services Provider.