Examples of Scams

Watch out for these known scams trying to impersonate the Sanlam brand.

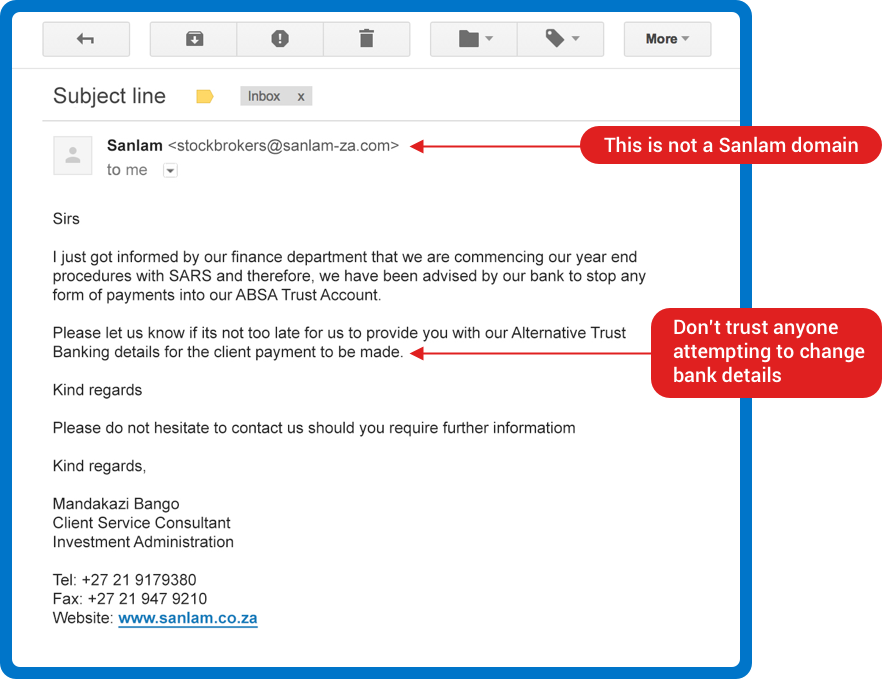

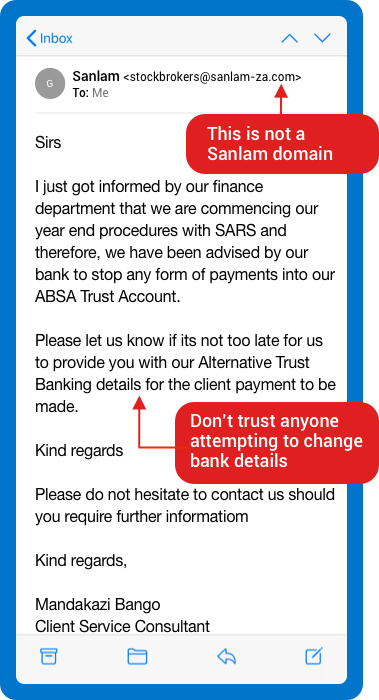

Change of Banking Details Scam

If someone contacts you claiming to be from Sanlam and asks you to use updated banking details to make payments, it could be a scam.

Sanlam is listed as a public beneficiary or public recipient at the major South African banks. Sanlam Life clients are encouraged to always confirm new banking details, or confirm banking details which you have on record, as a legitimate bank account of Sanlam by phoning us on 0860 726 526 before making any payments.

Don’t use the number on the communication that you have received, since this could be the fraudster’s bank details.

To make the request seem more legitimate, fraudsters may even attach an account confirmation letter as “proof” that their banking details have changed.

How fraudsters trick you into using fraudulent banking details

- They intercept an email you’re meant to receive and change the banking details on the email or invoice, causing you to make the payment into a fraudster’s account

- They create fraudulent business letterheads and send you emails, asking you to make future payments into their “new” account

Tips

- Beware of near identical email addresses. Fraudsters may add a full stop or replace a letter, or the email may subtly end with sanlam.co.za vs sanlann.co.za or san.lam.co.za

- Hover over the email address to make sure the response email address is the same as the email address of the sender

- If possible, use bank-approved beneficiaries when using online banking

Remember

Retirement Benefit Scam

Sanlam has been made aware of fraudsters pretending to represent well-known retirement benefits service providers, such as Sanlam. The fraudsters, claiming to be Sanlam employees, contact retirement fund members and mislead these unsuspecting clients into believing that additional funds are due to them. The fraudsters then obtain members’ bank account details, bank card numbers and CVV numbers, which they use to do fraudulent transactions from the members' bank accounts.

Vault Account Scam

International sources have informed us about a scam that is very effective with older people. The fraudsters contact the victim, presenting themselves as the fraud department at the victim’s bank. They inform the victim that fraudulent activity was detected on their bank account and suggest that the victim transfers the money from their account to a ‘Vault Account’ for safekeeping, while the bank “investigates the attempted fraud”. The ‘Vault Account’ is owned by the fraudsters and the victim loses the money.

Change of Bank Account Details Scam

The information highlighted with the red flags indicates that it is fake.

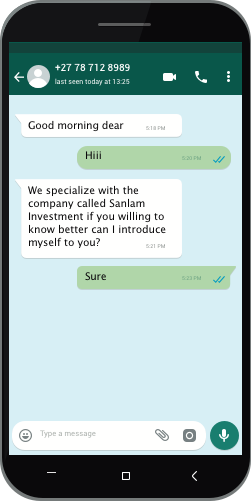

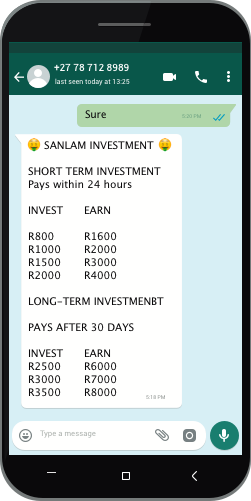

Fake Investment Schemes Scam

Be aware of recent scams that impersonate the Sanlam Brand and target potential customers via Facebook or WhatsApp.

Fraudsters have shifted their focus to WhatsApp, Facebook or SMS because users are now more vulnerable to scams on mobile phones, as people find themselves being more distracted and often don’t apply the same vigilance on their phones as they would on their computers. The scams are quite focused and conversational, which creates trust, so please ensure that you always verify all messages received.

How does this attack work?

- You receive a message via Facebook or WhatsApp, advertising a fake Sanlam investment product. The returns of these investments are too good to be

true, but to the uninformed investor, this looks like a very good opportunity.

- The fraudsters often use names of Sanlam senior management, as well as Sanlam branding and even provide Sanlam brochures. The fraudsters

source all this information from public platforms, like internet websites.

- Victims who fall for this are then asked to join a Sanlam branded business WhatsApp group and are instructed to pay the investment amount into a

nominated bank account and provide proof of payment

- Once payment is done, the victim can no longer gain access to the WhatsApp group and usually ends up calling Sanlam

What to watch out for:

- Any random messages (email, SMS or WhatsApp) trying to persuade you to transfer money to a beneficiary account number that you have not dealt with before

- If the offer sounds too good to be true, it usually is (fraudsters pry on emotions like fear and greed)

- When receiving anything unexpected, always say to yourself: "Stop – Think – Verify". You can also contact Sanlam to verify.

If you have fallen prey to such a scam, report it online. Here is an example:

Hacked Email Account Scam

This is an attack that shows the value of keeping your email account safe:

Someone manages to hack into your email account by guessing your password or tricking you into handing over your password by a cleverly crafted phishing email.

When logged into your email account, the fraudster sends Sanlam fraudulent instructions and deletes all of these emails without your knowledge. They can potentially also use your email account to reset passwords for other services you might be using that allows such changes. Should these sites not send alerting messages to your cellphone, you will not know about this.

This is a common fraud pattern and very dangerous as you may not even be aware of it happening. Due to this risk, Sanlam doesn’t accept high risk instructions by email only and will confirm such instructions with a phone call.